Mr. # Last Name #;

The purpose of this Monthly Report is to update the global statistics tracked in prior Monthly Reports to reflect changes that occurred through December 30, 2011. All information contained in this Monthly Report is as of December 30, 2011, unless otherwise indicated.

SCOPE:

The analysis contained in this report relies upon our modeling of DTC and other information. Historical evidence indicates that our modeling techniques are generally accurate when the modeling is applied to broad groups of investors. However, the precise activity of any individual investor within any particular group often varies significantly from our modeling. Our modeling represents our best estimates of the underlying economic realities, trades and transactions that, in our opinion, best explain the activity we observed while monitoring the DTC and other data through the cut off date. As with all modeling of this nature there is probability of error when using these techniques as a basis to explain historical behavior or predict the probabilities of future events. Given these constraints we can make no warranty or assurance as to the accuracy or reliability of the conclusions contained in this report.

MARKET COMPOSITION:

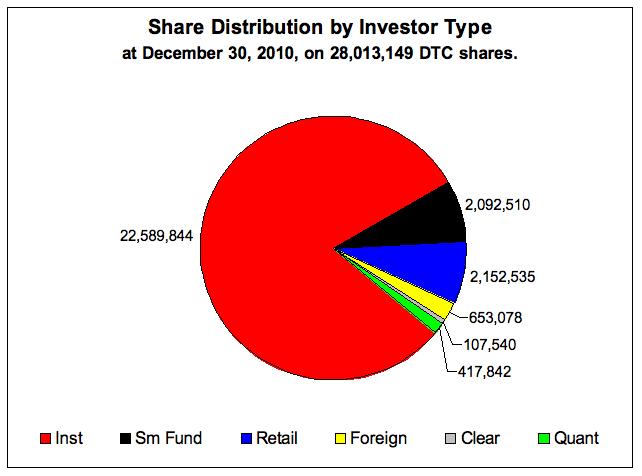

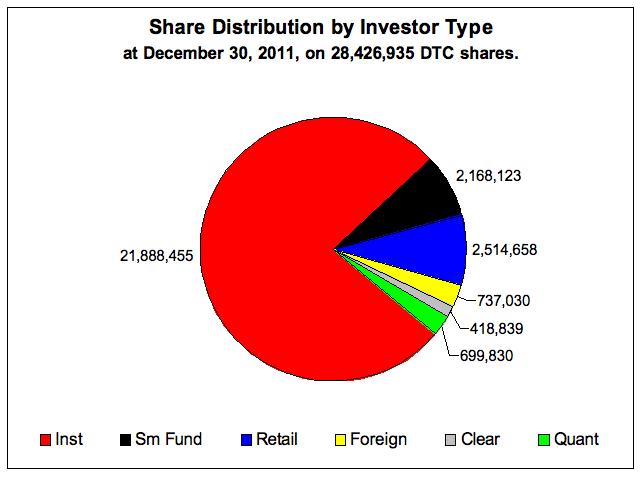

The relative market composition for # Company Name # Common stock (hereinafter "ABCD") as of December 30, 2010, and December 30 2011, was:

As the charts indicate the markets for ABCD shares broadened somewhat toward small fund, retail, foreign and other categories over the past year but the composition remains overwhelmingly institutional.

POSITION CHANGES BY DEPOSITORY:

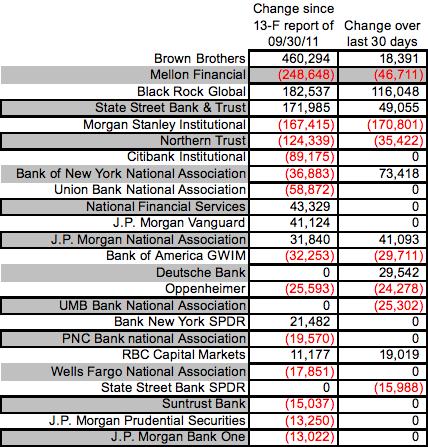

The major (>= 10,000 share) changes in position by depository from the last 13-F report date of September 30, 2011, through December 30, 2011, and from November 30, 2011, through December 30, 2011 (the last 30 days), were:

As was reported through your Weekly Service, The gains at Brown Brothers are almost exclusively Fidelity core positions as they were taken into custody from settled forward purchase and other leveraged accumulation arrangements. The gains at BlackRock Global represent approximately 100,000 shares coming off loan as certain short and hypothecated positions settled and the balance being purchased additions by BlackRock. Our modeling indicates that the acquisitions at State Street Bank were broad in nature taken in by William Blair, Artisan, as they were managing most of Fidelity's settled leveraged purchases, accumulations by SSgA and year end buying from other various state pool managers.

According to your Weekly Service modeling the dispositions at Mellon Financial were led by stock forward sold to Fidelity followed by profit taking at Wentworth Hauser along with sales or profit taking by Bank of New York Mellon and New York State retirement entities. Our Modeling indicates the dispositions at Morgan Staley were mostly Wellington and Morgan Stanley proper as both Wellington and Morgan went negative on 2012 market prospects in December 2011. The dispositions at Northern Trust were modeled as a combination of loans by Northern to partially fund share replacement at BlackRock as well as sales by Northern and profit taking by Cramer Rosenthal clients. The modeling also indicates that the dispositions at Citibank were mostly quantitative investors closing gain positions for year end purposes.

SHARE AGE AND BASIC CALCULATIONS:

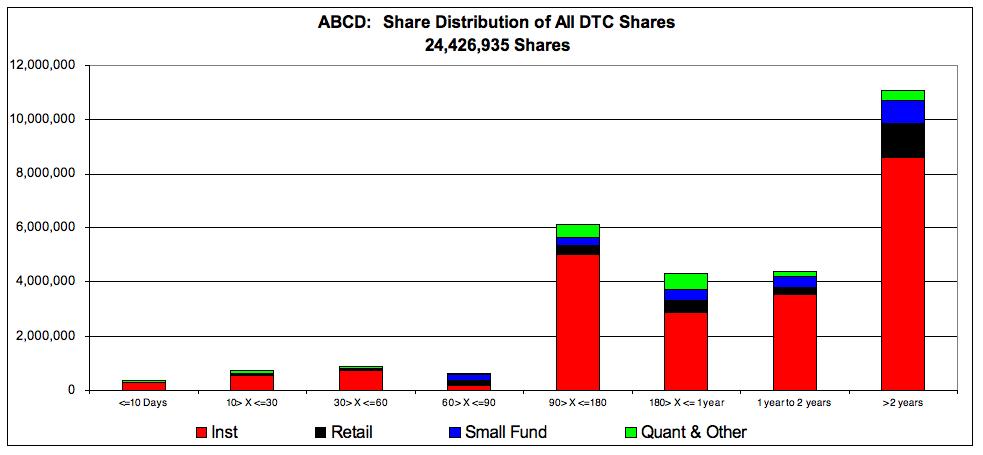

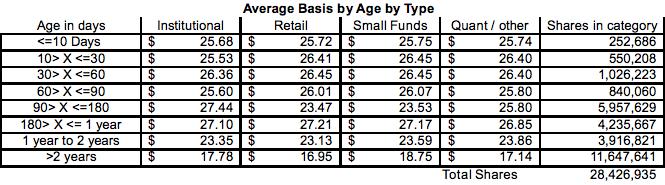

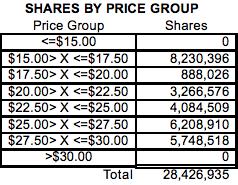

The year end share age, price distribution, and shares by price information was:

These statistics continue to show that the investors in ABCD are dominated by long-term, buy and hold, value, investors who exhibit reduced short-term and / or quarterly trading activity. This is especially true of the 8 million shares acquired at prices below $17.50 per share as those shares continue to age with few trades. As a result of this holding pattern the respective share basis resides completely between $15.00 and $30.00 per share with the total average basis being $22.57 per share which is up nicely from the $22.46 average investor basis as of November 30, 2011.

AT RISK VALUATION & EXPECTATION MODELING:

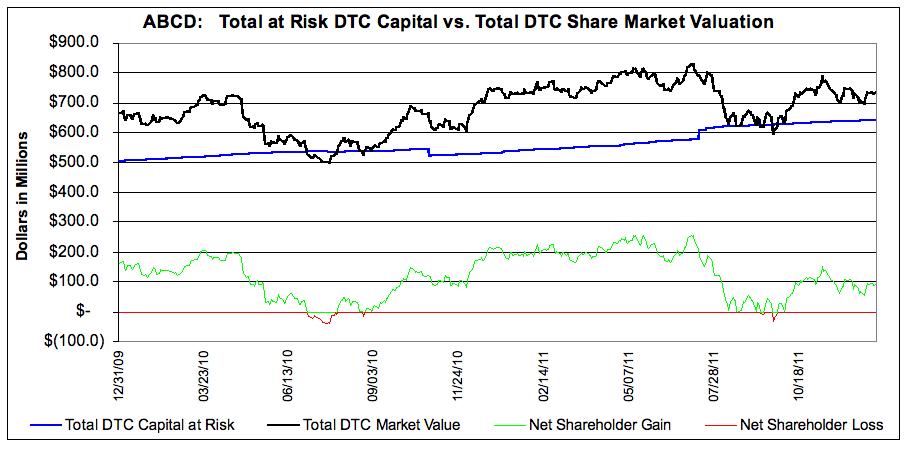

The year end At Risk DTC capital vs. DTC Market Valuation statistics were:

with the graph above showing the shares closing out the year maintaining the bulk of the investors gain positions that occurred after the Q-3 2011 earnings report.

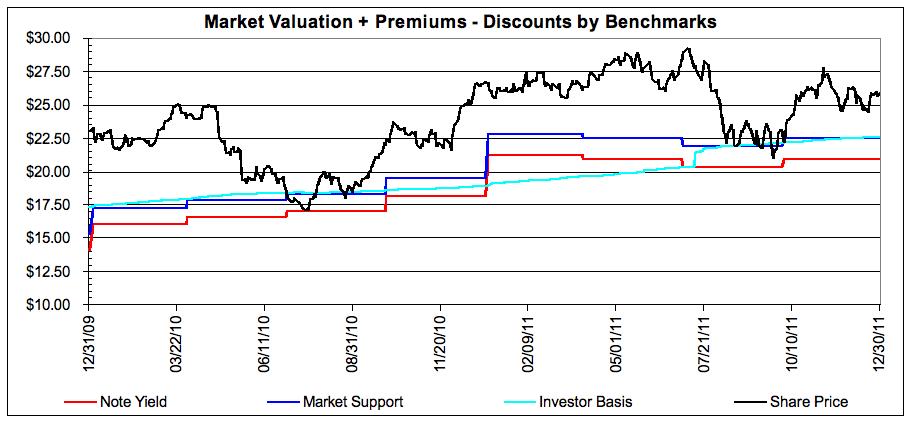

The market valuation by benchmarks analysis as of December 30, 2011 was:

and as we can see here the Market Support metric which approximates the sum of market premiums and discounts as well as the investor basis were both rising as of the end of the year indicating that investors expect full year 2011 earning to be at the top of the range or slightly beat the $Y.YY per share expectation. The note yield measure remained static as there was no year end adjustments to company borrowing costs or earnings expectations. The sum of the measures indicates that current market wide expectations support repurchase prices for ABCD shares of roughly $22.50 a share.

TRADING AND LIQUIDITY:

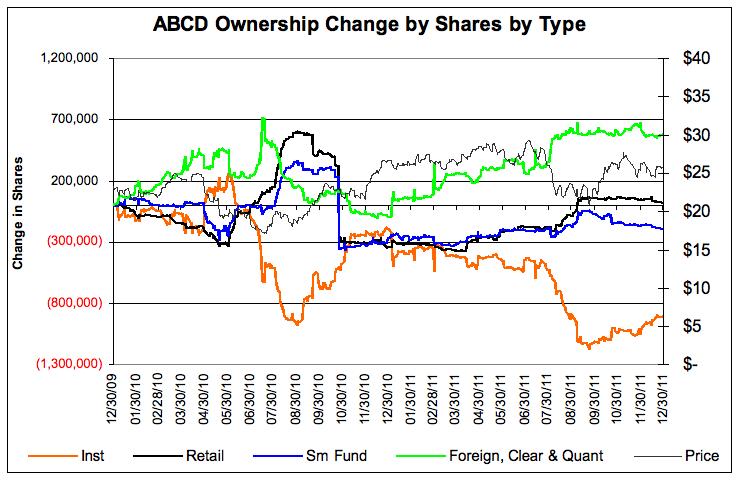

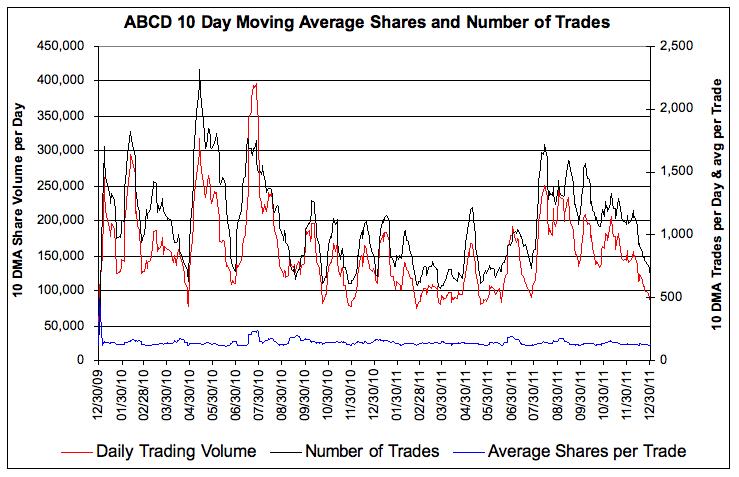

The year end trading and liquidity statistics were:

with the ownership change showing the previously mentioned increases in small fund, retail, foreign and other as institutional ownership declined somewhat but the chart above also shows increasing institutional interest in the closing months of the year.

The liquidity analysis is substantially unchanged since our last report with the exception of the predictable slowing in volume and trading toward year end.

CONCLUSION:

Current market expectations for ABCD stock remained substantially unchanged through year end. The difference between expectation by investor type remains minimal meaning that all classes of investors expect that earnings will be to the top end or marginally beat the $Y.YY per share median expectation. We expect some of these metrics to change materially for the January report as investors adjust positions in advance of the earnings report in early February and adjust portfolios for the new year in general and will appraise you of the changes in time to integrate into your Q-4 conference call. We hope you found this monthly and year end report helpful and as always if there are any questions, comments, clarifications or desires for additional information please do not hesitate to call.

Don Kundinger President,

Jackson Hole Advisors Inc.

//

//

NOTHING FOLLOWS